Wigton - The Final Word

Hey guys, guess what the wind just blew in?…One last post on the Wigton prospectus on the last night that it’s open. Scroll down to see what I’ve put together for this IPO Review, on Wigton Wind Farm.

Disclaimer: This is simply an overview of the Wigton Prospectus as interpreted and simplified by me. I have based this overview on information obtained from sources believed to be reliable, however I do not make any guarantees as to the accuracy or completeness of the information within this document. This overview is also simply for information purposes only and should not be construed as a recommendation to purchase or not purchase shares in any company. Any such decision should be based on your own analysis of the prospectus and advice from a licensed, certified financial adviser and/or broker.

Also, if any calculations are wrong. It’s definitely my fault. Trust, but verify.

In addition to the above, I have to tell you that the main objective of this overview is to break what can be a very scary document (the 179-page prospectus) down into a more manageable, and accessible document for regular people and while I hope it does help, it is NOT a substitute for reading the prospectus. Always read the prospectus. That is the company’s official agreement with you. This isn’t.

This however, is written specifically with non-finance and non-business people in mind. It was also written with the expectation that someone who may never have even heard about this offer (I know, it’s hard to believe anyone could’ve missed it with all the marketing) can read it, and gain an understanding of what the offer is about. So, if you are wondering why “obvious” things that “everybody already knows” are being said, spare a thought for the one person who might not have known and didn’t want to seem dumb by asking. The aim is to include everyone, experts and regular people.

A second warning specifically for the experts. I simplify a few concepts in here. Yes, there may be exceptions to some of my simplifications, or other factors that finance experts know (and often feel they just haaave to say 🙄), spare me of them please. Again, this piece is aimed at the common (wo)man who doesn’t know (or care) about the deep financial ratios and “the implications for the possible impact on the hurdle rate of cash flow generation and its consequent impact on dividend runway or the debentures… 🤦🏾♂️” or any such thing. Most people just want a basic, practical understanding of what this is all about so they have a basis on which to make their decisions.

If however you read something here and feel you just can’t let it go, feel free to message me on Twitter and we can have an “expert” level debate if I’m up for it.

And again, for everyone’s sake, I am not a broker nor am I an official analyst. I cannot tell you what stocks to buy, cannot take money from you to invest and I do not work with any brokerage house. It’s illegal for me to even give buy advice, and also time consuming.

Let’s keep everyone happy and out of jail, especially me.

So, having gotten that out of the way, lets get into it.

What is Wigton Wind Farm?

Wigton Wind Farm is a small, independent, electricity producing company located in Jamaica. It currently has 23 employees and 3 sets of wind farms which they call “Phases”.

Where is Wigton Windfarm?

Their registered office is 36 Trafalgar Road, Kingston 10, but the company’s power generating “farms”, (which is what they call the groups of their large wind turbines) are in Rose Hill, Manchester. The farms were placed there based on various factors, but primarily because wind speed assessments done over the past 25 years show that area as having some of the highest average wind speeds.

How do they earn money?

They generate electricity from wind via turbines and sell it to their only customer, the Jamaica Public Service (JPS). Their use of wind makes them a Renewable Energy Company. Wind is also naturally occurring locally & is more accessible than other more traditional sources, like oil, or coal. This allows wind-generated power to have a lower overall cost since no fuel has to be imported to generate electricity and with a much lower impact on the environment since there is no waste from wind generation.

Who owns them currently?

They are currently 100% owned by the Government of Jamaica (GOJ) via the Petroleum Corporation of Jamaica (PCJ).

What is happening with them?

The Government is currently carrying out a program of what they call a “divestment of certain state-owned assets”, which is just a fancy finance way to say “they’re selling some of the stuff they own”. It is also sometimes called a “divesture: or “privatization”. This is not a new occurrence as divestments happen from time to time for various reasons. One popular divestment was the selling of 80% of JPS shares to the American company Mirant in 2001, and over the past 10 years at least 23 GOJ assets have been divested including the Norman Manley International Airport in October 2018. The latest asset identified for divestment under the current program is Wigton Wind Farm.

Unlike what has usually been done in years gone by however, the current GOJ administration is offering Wigton for sale to the Jamaican public, not an overseas entity. This means that (assuming the offer is successful) Wigton, and its assets should remain Jamaican owned. This further means any future profits, dividend payouts, etc. from Wigton, will go to the Jamaicans who participate in this offer.

What is the offer?

Wigton currently has 11 billion shares (and 1 special share). The GOJ is seeking to sell all 11 billion of those shares to Jamaicans at a price of 50 cents per share. This means they are selling the entire company to the public a total price of J$5.5 Billion (J$5.5bn).

The minimum amount you can buy is 2000 shares, which costs J$1000 in total. All amounts above that are sold in batches of 100 shares which cost J$50 per batch (J0.50c.per sharex100 shares).

Note, this restriction for sales in batches of 100 is only applicable for the IPO. After this stage is complete owners can buy/sell any amount they want with 1 restriction.

What is the Restriction?

The GOJ is selling all 11 billion ownership shares but keeping one special share (sometimes called a “Golden Share”) for itself. That share was created and is being kept for only one administrative purpose. That purpose is to restrict any one person or company from owning or controlling more than 10% of Wigton for the next 5 years. The GOJ has stated multiple times that this is one of the things being done to ensure that as many members of the public get a chance to buy in to Wigton. This rule will only last for 5 years however, after that, anyone (who can afford it) will be able to buy more than 10% of the company.

Note: It is possible for this rule to be changed before 5 years via 2 methods;

1. At a General Meeting of the company (with 21 days’ notice given before the meeting) where 100% of attending shareholders vote for the rule to be changed.

2. The GOJ could simply give up the Special Share. After which a 75% vote of shareholders at a General Meeting can change the rule.

Both of these scenarios are very unlikely to happen and would require heavy co-ordination and co-operation. It is more likely that the restriction on shareholding will remain for the 5 years. After that however, all bets are off, but the good thing is that, anyone who bought before and still owns at the 5 year mark, (especially those who bought during the IPO) will still own their shares and will have to be given a persuasive (aka a very good price) offer by anyone seeking to buy up shares to hold more than 10%.

Bottom line, the restriction is a very good thing for smaller investors, especially those who may not have a lot of money, as it prevents richer applicants from taking over the company and running it to their own benefit. It also forces everyone involved in the company to work together for at least 5 years.

Why are they selling it?

Well the current GOJ Administration has said that its current mandate is to improve the lives of all citizens by continuing to work towards the Vision 2030 National Development Plan to “make Jamaica the place of choice to live, work, raise families, and do business.”

They have also stated that they see the best path to doing this to be; improving the local economy, by empowering citizens while giving government enough funds to carry out more improvement programs.

That’s all a mouthful, but the simple version is, they believe that by selling Wigton to the Jamaican public, they can not only get money needed to carry out Government activities, but also provide opportunities to regular Jamaicans who participate while also boosting the economy. This is why they want as many people to buy in as possible. The official reason given is below.

What is the GOJ going to do with the money from the sale?

Good question. Some of the funds will be used to pay the expenses for this listing, the remainder goes to the Government. We don’t actually know as yet what the rest will be used for, but that is a separate issue from Wigton as a company. Think of this like a person offering to sell you a car. Are you more interested in what they are going to do with the money after you pay for the car, or are you more interested in making sure that the car is a good buy? In this case, we’re concentrating on the car. Note however that it is a complete sale of the company. None of the funds will be going back into Wigton, we are being offered the entire thing.

Is Wigton a Profitable Company?

Yes. Last year they made profits of J$826 million (J$826m) and have made profits of J$1.8 billion (J$1.8bn) over the past 5 years. They made this profit from sales totaling J$9.4 billion (J$9.4bn) over the same 5-year period (2014-2018).

Up to December 2018, they also had a total of J$2.3 billion (J$2.3bn) in accumulated profits (often called “Retained Earnings”) which was saved up over the 19 years that they have been doing business.

A chart showing their annual revenue and profit is below along with a breakdown of the numbers.

Can they make more profits?

Well, they seem to think so. The rates at which their single customer (JPS) pays them for electricity is determined by the agreements signed for each Phase of the Wind Farms. That information is not public, so we can’t get a firm answer on if they can raise rates or not. How I see it however is like this; there are 2 they can increase their profits:

1. They can get their operations to be more efficient, handle the business carefully, reduce any costs they can and produce more electricity. That could lead to more profit with the operations they have right now.

They are concentrating on doing this currently, with 1 publicly stated objective being a 90% or more up-time for their turbines and generating 169 GWh for the year. They have also paid off a US$49 million loan early and replaced it with one in JMD, which they say benefits them by preventing increased loan payments due USD/JMD exchange rate fluctuations.

2. They can expand the business which would should lead to greater profits (and hopefully, greater dividend payouts). Business expansion however, is not a simple matter for them as it has some technicalities that could prevent it, as do possible dividend payments.

Will they pay Dividends?

They are likely to and have stated that they are currently aiming each year to “pay out a dividend not exceeding twenty-five per cent (25%) of net profits after tax” while continuing to pay down their debt. Note that dividends can only be paid out of Profits or Retained Earnings.

Let’s look at an example of what a possible dividend from them could look like and how you would gain. We’ll use their previous year’s profit as the start, and assume that you invested J$100,000 in the IPO.

That would mean that they could declare a dividend of J$0.04c. If you bought shares at the IPO for J$0.50 and then got that dividend your payout would be equal to 7.5% of whatever you invested. Compare that to the average Jamaican Savings Account Annual Interest rate of 0.67%.

It is also important to note, that there is no guarantee that dividends will be paid or paid consistently and they could change their Dividend Policy or stop payments for any number of reasons, both good and bad. For example, if one year the company decides to invest in a project and fund that project from profits, they may not pay a dividend during that time.

They have also signed certain agreements as a condition of loans that the company has taken which prevents them from paying any dividends if they pass certain “danger points” or red flags.

These danger points are 3 financial ratios that often indicate when a company is heading into trouble. The company is freely able to pay a dividend however once these danger points have not been passed and they have profits available to pay out a dividend from. An explanation of the “danger points” and the standing of each as at the end Dec 2018 is below.

Danger Points

Minimum Interest Coverage Rate : The amount of loan interest payable in a time period should not surpass EBITDA figure by more than 25%.

Danger Point Ratio: 1:1.25 Actual: 6.86:1 (6.86x)

Maximum Debt to EBITDA Ratio: This says that their overall debt should not get bigger than 6.5 times their annual profit (before paying taxes and loan interest and other things)

Danger Point Ratio: 6.5:1 Actual: 2.58:1 (or 2.58x)

Current Ratio: This shows their ability to pay any loans, bills, etc. that they have due within a year or less. Those short-term bills should not pass any short-term investments, cash or other assets that they may own by more than 50%.

Danger Point Ratio: 1:1.5 Actual: 1:0.14 (or 6.98x)

N.B. The actuals are assumptions & calculations made based on personal interpretation of the ratios & the Unaudited 9 Mo Financials. They are NOT from Wigton or any person/entity affiliated with them. No guarantee is made towards their accuracy. Further Note: I’ve been reading the reviews from every broker, they all have different numbers for these ratios🤦🏾♂️, but the main point is that Wigton is not currently in breach of any of the requirements and free to pay a dividend if they think it best.

What About Business Expansion?

They have already planned a build out and expansion into a 4th Phase which would be their largest yet in terms of total generating capacity. They have stated clearly however that it is not feasible for them to do that expansion unless there is a bid for additional generating capacity and they win it. In Jamaica it is against the law to generate or distribute electricity to any premises other than your own unless licensed to do so by the Government. Only JPS is licensed to buy from Independent Power Producers, everyone else has to buy from JPS. This is called ‘The Single Buyer Model’. Because of this, any company expansion that happened without JPS requesting it would be wasted as the energy generated there could not be legally sold to anyone else.

There was a bid in 2015 but they did not win. It was won instead by a solar company. Wigton has mentioned multiple times that they are not restricted from entering the solar business in addition to their current wind business, and may consider doing so in the future if it is determined to be feasible.

Do they have any Competitors?

There are 9 Power Producers in Jamaica including Wigton. Wigton has the second highest contract capacity out of all the Private Power Producers. However only 4 generate electricity from Renewable Sources. Of those 4, Wigton is the largest. Note, there has been a preference by the GOJ for Renewable Sources of energy to be used whenever more electricity generation is needed. This point works in Wigton’s favour as 100% of their product is generated from renewables. On the flip side however, they’ve lost bids to Solar Power Generators. So their field, while small, is very competitive and new players are entering it.

Who should buy?

I can’t tell anyone to buy, however from my POV, Wigton looks well suited for anyone aiming for 1 or more of 2 things;

1. Long term price appreciation & long-term dividend payments.

2. Direct ownership of an asset that our tax dollars help build over the years.

While none of these things are guaranteed, I can assure you that the companies and people who have a lot of money and are always seeking out opportunities to make more, are going to buy. Also, it’s not often that an opportunity comes up that looks attractive to those companies AND includes restrictions to ensure a space for the smaller people to be included. Many people alive now have never even seen an opportunity like this before, and some who have, couldn’t get in, or didn’t know anything about it. Consider all these factors when making your decision.

How can we buy?

Ok, so for the nitty gritty. You are going to need a broker. You’ve probably seen the lines around the block and you’ve heard the talk, maybe you don’t have an account, maybe you don’t know what’s needed. If you want some more general information on IPO’s in Jamaica and how to participate, then check this out. But act fast, there’s not much time left. You have literally today (April 30th 2019) and tomorrow. It’s slated to officially close at 4.30pm tomorrow. There may be an extension, but I wouldn’t bet on that.

There is another way to apply however. NCB Capital Markets has set up a website from which anyone can apply for any IPO, even if you aren’t and NCB Capital Markets customer. The process is pretty seamless and if you have access to the internet (which you do, since you’re reading this), and access to online banking and a printer. You can apply from anywhere. If you’re an NCB customer with a signature on file already you wont even need a printer. Just fill out the information online, and hit submit. I know a few people who have used it (NCB customers and non-customers). They all say it was a great experience. Skip the lines and the last-minute rush and check it out here. —> NCB Go IPO.

In the event that you still need to visit a broker, take a look at the list of all participating ‘selling agents”.. Note also that it’s slated to close tomorrow, May 1, 2019 at 4.30pm. However there may be an extension, 🤞…but don’t bet too much on that.. If you do miss it however, when it becomes a publicly listed company, You’ll have an opportunity to buy in again, assuming you think it’s a good deal.

Will it be oversubscribed and will we actually get any shares?

Yes, and yes. With all the heavy promotion that this is getting, it is very likely that this offer will be oversubscribed. As to whether or not you’ll get ALL the shares you applied for, that’s another matter. The GOJ however has again tried to help. They mandated that in addition to ensuring no one could own more than 10% of the company for the 1st 5 years, they also reserved 2.2 billion shares just for Public Sector Workers and then put in a rule that the allocation of all shares (Regular and Public Sector Reserve) was to be done via a “bottom up” method, which is designed to give shares to the people who have the smallest amount of money first. The aim is to get as many people as possible at the very least access to 10,000 shares (J$5000). Of course, many people will apply for more than this, and so the idea is to assign shares upwards form the smallest to the biggest. They have also promised to make any further tweaks, if necessary, after all applications are in to ensure that as wide a cross section of Jamaicans as possible get to participate in the offer.

Anything for the 1st timers?

I would just give you general stock advice, which I’ve found to be helpful to most people starting out.

1. It’s NOT as complicated as it might seem. If you can read and think, you are more than capable of doing this. Trust me. (even if you don’t trust me, just stick with it, you’ll see).

2. Respect The Research. You don’t have to go digging and be an expert, but at least pay attention to the sources of information around your investments. You don’t have to follow the stocks movement’s every day, but check out the business news every now and then and check the stock Exchange’s website at least once every 3 months to see how your pick is doing.

3. Have a plan. An actual plan, with an actual timeline in mind. That way you can measure how the stock is doing against your timeline, don’t go crazy if it’s lower than you expect in 2 months, but your timeline is 3 years. Go in with a plan.

4. Track your portfolio. I made an Excel file to help you do this. It’s very simple. Enter how many shares you bought on the Purchase Sheet and the price paid, and type the stock name on the Dashboard sheet. Hit the red refresh button every day and it will automatically update with the day’s latest prices and your portfolio value.

5. Check out www.everymickle.com for more updates and articles and tools and so much more that’s coming to help you.

One last thing for the new crowd. Know what real profit is. While IPO buyers will get their shares for 50 cents flat at 1st, whenever they are ready to sell there will be additional fees to be paid. Assuming the offer is successful (it will be) and successfully lists on the Jamaica Stock Exchange this year (2019) (it will), those who bought at IPO prices will need to sell each of their shares for more than 52 cents in order to make a profit. (Note: This calculation does not take any possible dividend payments into consideration. Any dividend an IPO purchaser would receive, would reduce the price that shares have to be sold at in order to make a profit)

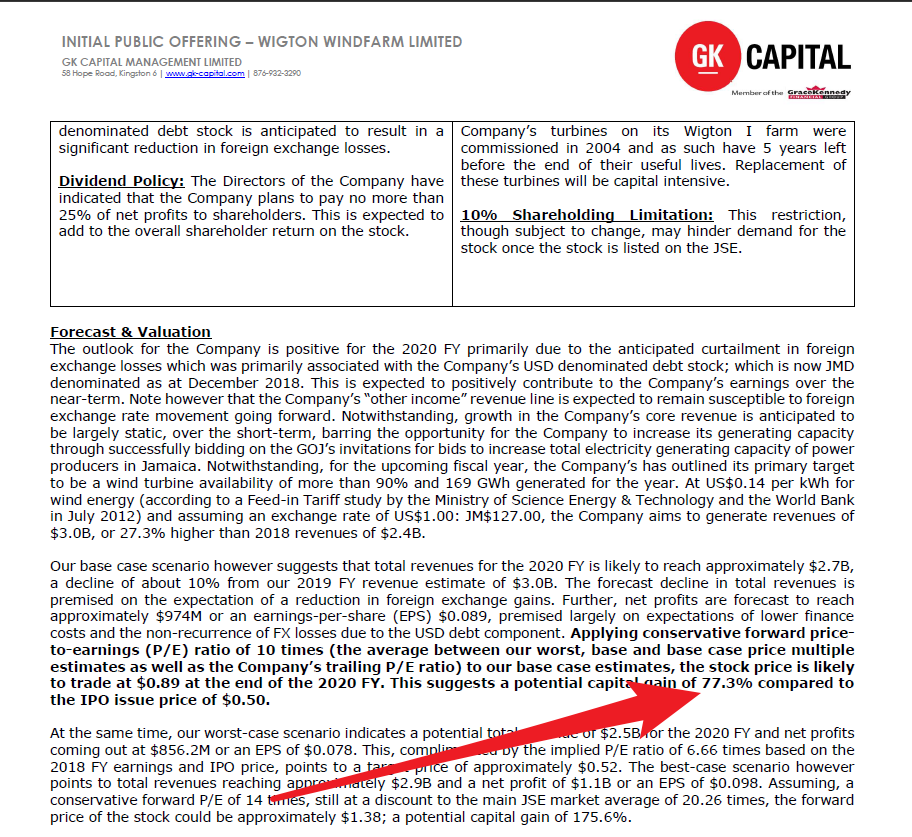

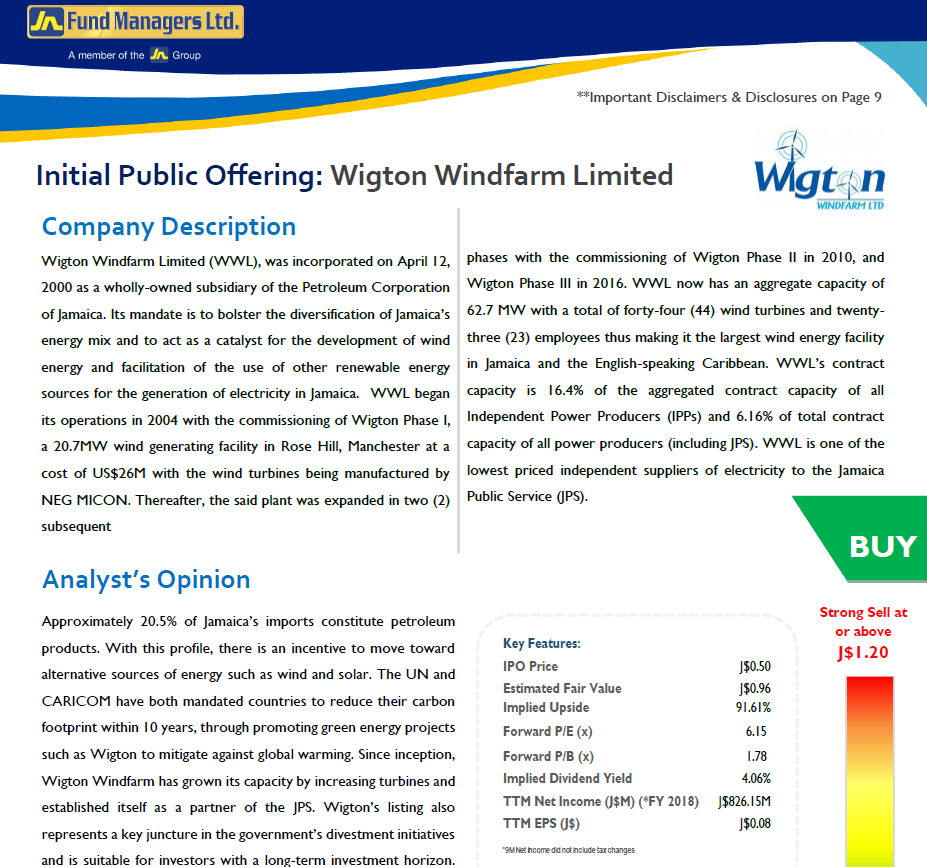

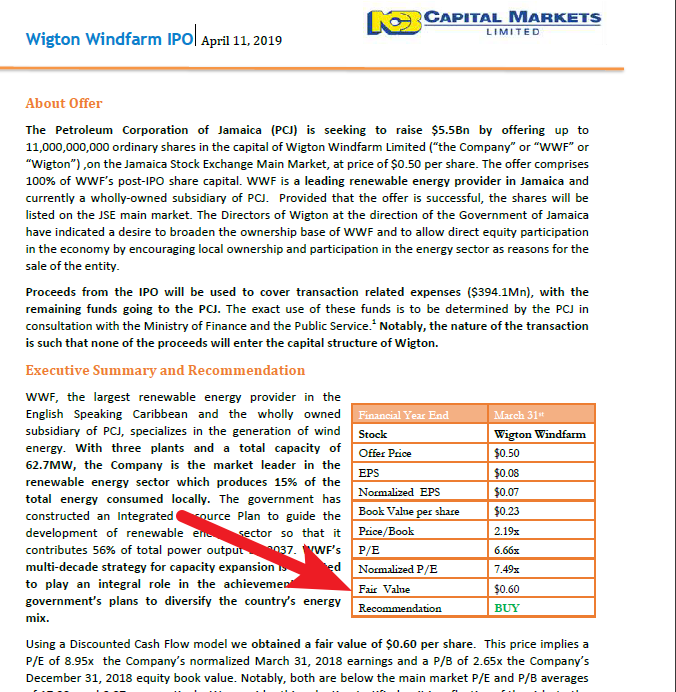

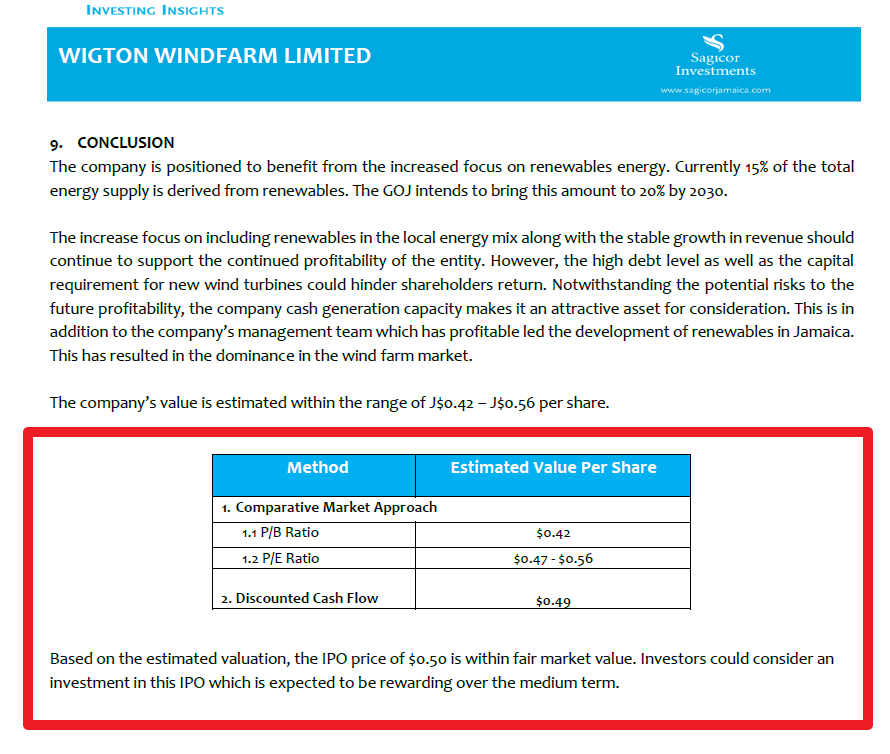

What are the experts saying?

Here is a quick view of what some of them think.

Anything I should look out for or pay special attention to?

· The Quarterlies. All listed companies are required to report to all shareholders every 3 months (aka a quarter of the year). Wigton’s last Report was for their 3rd quarter (9 Months). In it they showed that they had already achieved 88% of the profit they made last year. This may be a good sign of them being able to beat last year’s profit. The final year data will come out after they list. (Assuming the offer is successful)

· The Debt. There is a bit of complication with this point so I didn’t get into it earlier but essentially Wigton is debt heavy and has a been for years. This is not strange, especially for large companies. They borrow large loans to fund projects and then repay those loans from the proceed of the projects. Wigton refinanced all its loans and changed them over from US$ loans to $JMD. This has benefited them, however keep an eye on their payments to make sure they’re meeting them all and not increasing debt needlessly.

· The Maintenance (Turbine Replacement). Each Phase of the Windfarms comes with a life limit of sorts. Turbines are rated to perform for 20 years. The 1st set of turbines will reach their 20th year within the 5 years. Pay attention to how Wigton plans to replace or rework them.

· The F/X Gains. This one is even more complicated but essentially Wigton sometimes gains from the movement in the USD/JMD rate and sometimes they lose. This gain is reported as “Other Income”. A large part of the profit from last year was due to them gaining from USD/JMD rate movement. Some people, including some brokerage houses, don’t consider this to be real profit because they say it is often not repeatable, and have discounted it from their reviews. The ones I have seen still state that even without the F/X gains Wigton is still a worthy company and still profitable. Interestingly many of those same Brokerage houses have F/X gains in their own Financial Statements and they don’t remove it when reporting and they speak about the entirety of their profit without discounting it. Pay attention to what they say…but pay even closer attention to what they do. Up until Dec 31 2018 (the 9 month report) Wigton had earned J$587M in “Other Income”. Roughly $552 of that figure was F/X gains. They seem to have managed to repeat it. Pay attention to ensure that you know 1st if they keep it up.

Hmm, anything else?

This is a simple (though LONG, sorry) look at a company that I personally believe will come to market and bring value to a lot of people over its lifetime. There are a whole lot more things to be said about it and its interaction with other entities, the possible plans of the Investment Banks, and the effect this listing will have on other companies and divestments to come (JPS anyone?). That’s where even more value can be found and that’s where I intend to carry the conversation. See it’s not just about which stock to buy or how much money to put in. It’s about understanding the changing business landscape, and ensuring that as things and times change in Jamaica, you change along with them and not get left behind. The investing space in Jamaica is changing greatly. There is room for everyone, make sure you take your space.

What I will say with regards to investing overall is that when thinking about stocks, don’t get lost in the numbers, don’t think it’s all academic, companies are only as good as the work they do. The numbers are the company and the numbers tell the story, but that’s not the only way to hear the story or predict the next moves, neither is it the most important, logic and common sense are the most effective tools I’ve seen used across the local investing realm. Those who have and us it, are never far from profit. Learn the numbers, but think about companies in the context of the overall country. For Wigton, I’ll leave you with this bit of practicality. Over 50% of the Jamaican population is under 30 years old. Many don’t remember (or even know) about the days when we used to have rolling black outs, “load shedding”, constant electricity shortages, etc etc. Now, things are different, even taxis have WiFi, and beggars have iPhones. Thinking practically, do you really believe that as the cellphone generation gets older, earns more money, buys more homes, appliances, gadgets, etc that they’re going to use LESS electricity?

Keep those things in mind…and look out for year 5 when the 10% restriction drops…. That might be it’s own Red Wedding.

See you on the Gains Train…

- Randy.

P.S. Sorry for being so late with this and double sorry for leaving the site quiet for so long. Life got in the way. I’m fixing that now. Thank you to the people who call(ed) me out on it every chance they get.