David's Data- Palace Amusement Company (1921) Limited: Jamaica's Movie Company

Palace Amusement (1921) Limited: Jamaica’s Movie Company

Hello, everyone! Here’s the latest installment of David’s Data, where he gives a comprehensive analysis of Palace Amusement (1921) Limited. Leave any feedback you have in the comments below or you can send them directly to David at his Twitter account or at our own Twitter or e-mail. Enjoy!

-The EveryMickle Team

As movies tell a story for the viewer to decipher, The Palace Amusement Company (1921) Limited has been the company to tell thousands of stories over a big screen throughout Jamaica’s history. Before there was wide access to TV, DVD’s and internet service, Jamaican’s flocked to a Palace screen to enjoy themselves with a glance of Hollywood, Bollywood and other films from around the world. From an open air setting, you could enjoy a film on a lazy day and forget about life’s stress. If you felt the need to travel with the family for an evening show, one could watch a film at the drive-in-theatre at Harbour View, Washington Boulevard and New Kingston. All roads led to a Palace destination, regardless of whether there was a roof or not. Palace was the place to kick back and relax. By the way, if you haven’t watched The Harder They Come, Third World Cop, Bolt or Sprinter, be sure to go and check them out. Today’s analysis will explore the history of this treasured company and its influence in Jamaicans lives.

“The company operated theatres in Kingston with names such as Regal, Odeon, Tropical, Ambassador and Queens while the rural one’s were named Royal, Capri, Astor, Arcadian and Imperial.”

The 99 year old company has been the dominant force in Jamaica for the movie exhibition business. The company operated theatres in Kingston with names such as Regal, Odeon, Tropical, Ambassador and Queens while the rural one’s were named Royal, Capri, Astor, Arcadian and Imperial. Although these are relics of the past, the theatre will have a special place in the heart of many who grew up learning about the world despite never setting foot in another land, perfected their English from hearing the foreign speakers and the start of many long-lasting relationships. Today, the company operates 4 theatres, which serve Jamaica’s relatively young and avid moviegoers. Palace Cineplex is based in the popular Sovereign Centre in Liguanea, Kingston. Carib Cinema (Carib 5) is the phoenix which rose from its ashes at Cross Roads, Kingston. Palace Multiplex is based at the Fairview Shopping Centre in the second city’s capital Montego Bay. Sunshine Palace, which is the newest location, is based in the Sunshine Outlet Mall of Portmore, St. Catherine. These locations have their respective histories, but they all serve the same purpose.

Founded in 1921 by Audley Morais, Palace first operated in the silent movie theatre days. In 1947, J. Arthur Frank bought the controlling interest in Palace Amusement and then bought out the Cinema Company of Jamaica. Mr. Frank then built the Odeon in Mandeville and Odeon in Half Way Tree which both survived into the new Millenia. In 1949, Russel Graham built the Tropical Cinema Company and subsequently bought the controlling interest from Mr. Frank in 1962 through his company Russgram (Russel Graham) Investments Limited. With control of the company, Russel appointed his son Douglas Graham as the managing director of the company, a position he still holds today. The duo took control of the Majestic Cinema and Tropical Cinema Company while also building the Harbour View Drive-In as a partially owned subsidiary. On July 12, 1973, Palace Amusement was listed on the 4-year-old Jamaica Stock Exchange (JSE). In 1989, Douglas bought Russgram Investments Limited from his father which gave him control of the Palace Company. In 1996, the Carib Cinema was burned down by a fire. However, it was rebuilt with the iconic name Carib 5 coming from the 5 screens which now occupied the new theatre.

As the advent of TV and DVD’s became more available to Jamaicans, there was a rise in piracy. When coupled with the financial disaster of the 1990’s known as Finsac (Financial Sector Adjustment Company) and high inflation, Jamaican’s began to visit the movie theatre less. These factors led to the scaling down of the giant’s dominance and for the company to transition to the new high quality screens viewers desired. This included the sale of the Odeon in Half Way Tree in the 1990’s, an exit from Portmore in 2004, the sale of the Rialto in 2008, another exit from Mandeville in 2014 and, finally, the sale of the Harbour View Drive-In in 2018. Notably, Mandeville was considered the piracy capital of Jamaica and the Harbour View Drive-In was severely damaged by Hurricane Dean. The drive-in had its last viewing on September 9, 2004 before the hurricane stroke. The decrease in real GDP (Gross Domestic Product ) per capita (GDP with respect to a country’s total population with inflation factored in) which came with the Finsac damage left many Jamaicans poorer going into the new Millennium. The introduction of home theatre systems, digital streaming and age of online piracy have become new threats to the company. However, the company has begun to see a resurgence once again in viewership by the under 40 demographics. The company sought to have a new location in the Constant Spring area during the late 2000’s and finally decided to re-enter Portmore as the macroeconomic climate became more feasible.

Financial Analysis

Palace Amusement struggled from their 2002 Financial Year up to the 2016 Financial Year to generate the level of demand they needed in order to generate net profit margins above 5%. This can primarily be linked to the devaluation of the Jamaican Dollar to the USD, as well as their inability to generate a sustainable pricing mechanism to match margins with operations and lack of local support for their product as consumers discretionary income got eroded by rising costs. This left management with no other choice but to absorb costs and rise ticket prices incrementally as needed without driving away remaining consumers. However, the last 2 Financial Years (2018 – 2019) have been full of Hollywood blockbusters which have managed to draw in greater crowds depending on the time of the year. This left the company with a relative competitive edge as consumers weren’t deterred by the ticket cost to visit the various locations and view movies more frequently.

“Palace Amusement’s revenue became extremely erratic during the period going as low as $352.8 Million and shooting as high as $513.2 Million before receding once again in the following year.”

Between 2002 – 2008, Palace Amusement’s revenue became extremely erratic during the period going as low as $352.8 Million and shooting as high as $513.2 Million before receding once again in the following year. Although the gross profit margin of the company remained relatively stable above 16%, the net profit margin was weak, around 2% most of the time with 2 years recording losses for the company. After the 2008 Great Recession and new IMF agreements for Jamaica, Palace’s revenue managed to grow for 6 consecutive Financial Years. However, the same problem associated with low net profit margins continued as the company never surpassed a 2% net profit margin before incurring a loss in 2014. After the disposal of the Mandeville location which was burning $8 to $10 Million yearly with losses and increasing ticket prices, the company managed to achieve a 20.67% gross profit margin and a 3.50% net profit margin. With new blockbusters appearing almost every year and some movies now grossing $1 Billion USD annually, the company began to see increased patronage at its locations. This, culminated with the February 2018 Release of Black Panther which resulted in Palace surpassing $1 Billion in revenues for the first time and surpassing $100 Million in net profit as well. Black Panther caused lines at the Palace Cineplex to wrap around the third floor of the Sovereign Centre as eager moviegoers flocked to watch this film, which resonated with the black culture quite well. The final quarter (April – June) of the 2018 Financial Year brought in net profits of $88 Million which was its highest ever quarterly net profit to date. 97% of the company’s net profit for the FY was derived in those final 6 months due to the reception of the films available at the time.

The pricing mechanism referenced earlier is in relation to inflation, the FX rate and ticket prices. In 2008, regular movie tickets cost $500 to $680 JMD. In 2010, 3D movies were introduced with ticket costs at $960 for adults and $660 for children. In 2011, 2012, 2014 and 2018, prices were raised across the board by $50 each time. The price for a regular ticket as of 2020 is $1,200 and a regular 3D movie is $1,500. The CPI for Jamaica in 2008, 2010 and 2020 were 136.9, 164 and 268.8. Thus, the real price in 2020 for a regular ticket is (136.9/268.8)*$500 = $254.65 and real price for a 3D ticket is (164/268.8)*$960 = $585.71. The real price for a 3D children ticket is (164/268.8)*$660 = $402.68. The real price for a regular and 3D adult ticket over 10 years has dramatically fallen in 10 – 12 years while the price for a child’s 3D ticket has remained relatively strong. Over the same time frame from 2008 to 2020, the JMD has devalued against the USD from $76.61 to $147.11 which is a 92% devaluation. If ticket prices were to have factored in the devaluation, a regular adult ticket would cost at least $2,400 in 2020. Thus, real price isn’t reflected by Palace when factoring in the backdrop of a price sensitive economy and devaluation of currency. This has left it with the option of pushing for greater attendance by consumers or increasing ticket prices which in this case, they chose the former. For comparison, an average ticket in the USA cost $7.89 in 2010. An AMC ticket price in 2020 for an adult can cost $13.69. Inflation in the USA didn’t run away like it did in Jamaica over the two decades. Nominal (just the flat value) prices for the ticket increased by 74% over the decade. Even when inflation is factored in, the price would still be high enough for the theatre to make a basic net profit and not be teetering along 1-3%.

“Even in April 2019, listed company Pulse Investments Limited rented out a viewing room at the Palace Cineplex for their Pulse Global Launch during the daylight hours.”

As the company has aimed to generate greater sales, it partnered in 2014 during the World Cup season to show some football matches on the big screen in partnership with SportsMax and embarked on a 2 for 1 ticket plan for consumers who watch films at specific times on Mondays and Tuesdays. This 2 for 1 ticket plan also extended to certain holiday’s such as Father’s Day as well. They also showed Bolshoi performances on Sundays, Met Opera and National Theatre (NT) Live performances to diversify their product offering. Even in April 2019, listed company Pulse Investments Limited rented out a viewing room at the Palace Cineplex for their Pulse Global Launch during the daylight hours. There are also private viewings whereby clients can rent out a theatre for special events and occasions. They have also partnered with Brawta Living, offered consumers the option of purchasing tickets online and loyalty cards (cancelled in 2018) as a way to ensure they can sell seats and sell as many confectionery items as well.

Segment Analysis

Palace operates in three distinct segments as highlighted by their audited financial statements. These include cinema activities (box office receipts and confectionery sales), film activities and screen advertising activities.

Cinema Activities

Ticket sales are the main source of the company’s revenues. They rent films from their parent company, ATM Film Distributors, Vista Entertainment Pictures and United International Pictures. When a film is well taken by the viewers as seen with Black Panther or Avengers: Endgame, they spread the word to their friends about the film. Along with Palace’s own in-house advertisements of films, films are advertised on television, digital channels and other mediums so that the end user is aware of the film’s near release. Despite box office receipts bringing in the most income, renting the film is not cheap for the company as it represents the greatest expense ahead of staff costs. Movie theatres sometimes share as much as 50% of ticket sales with the movie production company. Palace’s percentage cost for rental is unknown, but it undoubtedly acts as an incentive for the company to get more viewers for the film.

Confectionery sales make up the remaining section of cinema activities. Confectionery items include hot dogs, popcorn, nachos, soda, candy and drinks. These items usually have a fair mark up in order to make the cost associated with preparation and operating of the concessionary stand worth it. There are combo deals available for a variety of confectionery items which drives sales higher and ensured inventory doesn’t stay too long in storage or on display.

Screen Advertising Activities

Although advertising has been changing over the last couple of years, the opportunity to advertise a product in front of a large crowd is quite advantageous for some companies who want a large audience who will be expected to glimpse their product. This revenue source generates the lowest amount of revenue for the company, but it also doesn’t cost the company more money to display that advertisement since the ad is shown before the film starts when the projector must be in operation.

Film Activities

Film activities comprise of the purchase and rental of films from the distributors, and subsequent rental to cinema operators in the Caribbean. As the company highlighted in their history, they operated and rented films to territories such as the Cayman Islands. Film rental activities as a segment item generates a lot of revenue for the company and usually has a great profit margin. In the 2019 FY, the company generated $413.9 Million in revenue from this segment and had a segment result of $86.4 Million which was a 21% profit margin.

Balance Sheet Analysis

Since the company’s main operations involve the exhibition of movies, sale of concessionary items, advertising and film rental, the company’s asset base hasn’t truly expanded much over the years, with reductions at particular periods where there was a sale of some properties and reduction in current assets. With the advent of 3-D technology and greater motion picture experiences, the company has invested millions into this technology in order to display these films here in Jamaica. This is quite evident between 2010 to 2013 as the company’s total assets expanded from $383.7 Million to $518.6 Million which was mainly in the form of property, plant and equipment. When this is combined with the total liabilities not surpassing $200 Million (except 2013), the company has managed to grow shareholder’s equity in the last 6 years from $279 Million in the 2014 FY to $505 Million at the end of the 2019 FY.

“The company received its largest cash balance in recent history mainly thanks to the blockbuster season in the latter half of FY 2018. ”

The non-current asset portion of the balance sheet has varied significantly over the years as the company disposed of older locations which were non-performing or generating losses the company could no longer sustain. Thus, the company always had a larger portion of its total assets in the non-current asset segment specifically in the form of property, plant and equipment. With respect to their current asset base, inventories and receivables have been relatively stable over the period of time with receivables having a very low impairment provision (provision for credit losses) due to the entities which have been provided with this facility. The cash and cash equivalents of the company have always had a wide variation due to the needs of the company in meeting different obligations or needs to invest in new technology for the business. The company received its largest cash balance in recent history mainly thanks to the blockbuster season in the latter half of the 2018 Financial Year.

Current liabilities have made up the larger segment of total liabilities of the company. Most of these liabilities are payables which can be seen as an inherent feature of the business. Since the company has different vendors who supply different products, the use of credit (payable) is a good way for the firm to retain cash and pay as needed. However, the company’s working capital (current assets – current liabilities) has deteriorated in the last Financial Year with current liabilities exceeding the current assets. Non-current liabilities have been quite small and manageable for the company since the company rarely utilizes loans and deferred tax liabilities aren’t recognized in any given period.

Cash Flow Analysis

With the company having 4 years of losses over the 18 year period and net profit margins around 2% (excluding 2015 and 2017-2019), the company hasn’t truly been generating sustainable cash flow from operations as seen in the graph below. This was mainly as a result of some movie theatres under-performing and dragging the other locations with it. When the segment analysis was done, it could be seen that some locations were profitable with a specific location dragging down the results. This trend of low cash flow from operations changed after the disposal of the Mandeville theatre in 2014. Since then, they have managed to generate a steady cash flow, which has increased from $27.8 Million in the 2015 Financial Year to a high of $127.9 Million in the 2018 Financial Year.

The company has been consistently reinvesting into the business over the years as Dolby and other digital technologies enhance the theatre experience for viewers. Due to this, the company has been having a negative cash flow from financing activities (cash outflow) over the last decade. The largest years where there was a cash outflow was in 2018 and 2019 as the company prepared to open its Sunshine Palace location. 2019 alone saw more than $289 Million spent on property, plant and equipment. In some years, they disposed of the Mandeville, Harbour View and Rialto locations which provided some cash inflow in those times.

In order for the company to have maintained operations with certain locations such as the Mandeville and Rialto Cinema dragging on the company’s bottom line and operations, they utilized financing such as loans to support working capital and ensure the firm could meet any necessary obligations. This use of financing wasn’t frequent, but was more notably utilized in 2002, 2010 and 2017. Over the 18 year time frame, the company has paid out $20.8 Million in dividends to shareholders.

Industry Analysis

Palace Amusement operates in the global entertainment industry with respect to the subset associated with the motion picture industry. The global entertainment industry surpassed $100 Billion USD in revenue last year with global box office revenue hitting a new record of $42.5 Billion USD. Although North America was the biggest region for box office revenue at $$11.4 Billion USD, foreign box office revenue made up the bulk of sales at $31.1 Billion USD. In Jamaica, Palace Amusement has reaped two consecutive FY’s (2018-2019) of revenue above $1 Billion with $637 Billion being generated from ticket sales in the 2019 FY. This general increase in ticket sales is mainly due to renewed interest in attending movie theatres due to new theatrical releases and not due to ticket prices being raised. Palace acts as the exhibitor in the value chain off the motion picture industry with their parent being a distributor for Warner Bros, 20th Century Fox and Goldmine Productions.

Although the movie industry has been facing a lot of competition from digital services, it hasn’t dampened the revenue movie theatres earn from ticket sales. Movie franchises such as the Fast and Furious and Marvel Cinematic Universe have attracted a greater cross section of fans from a wide demographic market due to the length and nature of these continuations. There have also been more live action films and sequels of older animations which has drawn in older viewers and new one’s who crave the content of these films. These factors have led to more Billion USD movies in the last 5 years than prior decades. In 2018, the top 5 movies each grossed more than $1 Billion USD while the top 9 movies of 2019 all generated more than $1 Billion each. This is consistent with the shifting market as seen by the top 46 of 50 films in history now grossing more than $1 Billion USD.

Although the industry has been seeing relatively fewer unique visitors to the movie theatres as more persons opt for digital release, repeat visits to the movie theatre by intrigued fans has kept the industry quite vibrant. This lead many to see the industry as recession proof within the context of the last 5 recessions (excluding COVID19) not significantly denting the sales of the industry in the following 2 years after the recession. However, COVID19 has been the differentiating moment for the movie industry since this recession was not driven by a financial implosion or war, but by a global health crisis. Even with the mass shootings in the USA, financial turmoil in the economy or digital consumption leading the shift in consumer tastes, COVID19 has effectively put the motion picture industry to a standstill. New releases have been delayed or suspended as shooting is paused and movie theatres remain closed as lockdowns took effect. This led ticket sales in the last week of March 2020 to plummet to $5,000 USD when compared with the $200 Million generated in the prior year.

Market Analysis

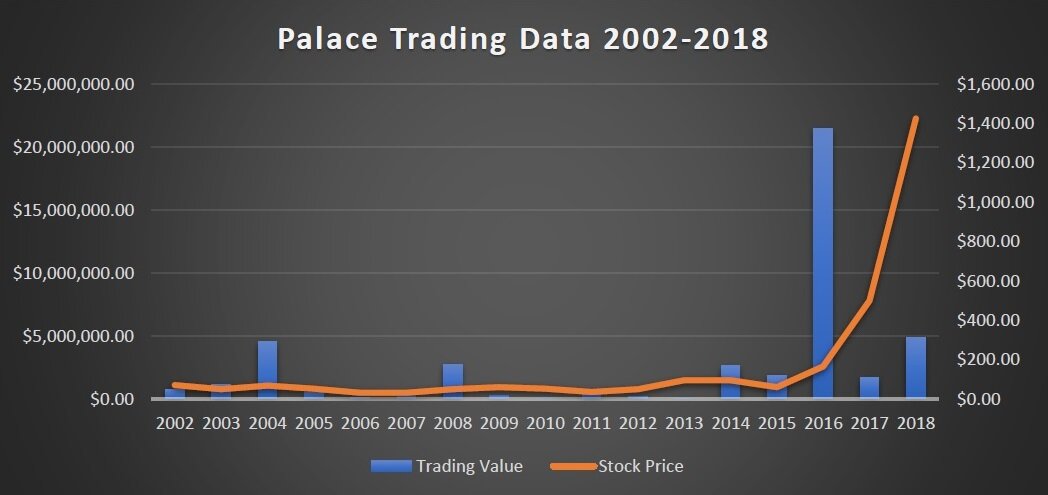

Palace Amusement’s stock price has been anaemic for the last 2 decades with fewer than 20 days of trading taking place in almost any given calendar year. The rationale behind this lack of activity stems mainly from the small shareholder base of Palace (less than 200), the top 10 controlling 87.70% of the outstanding shares (1,260,274 shares) and the JSE’s prior rule of at least 100 shares being traded (changing hands) for any given transaction for stocks on the market. These factors combined with mixed results over that same time frame saw the Palace stock price unchanged in some years and rarely being traded over the same time frame. This meant the company’s price would rarely move on the announcement of good or bad news. With the JSE being declared the world’s best stock exchange and the macro-economics of the country improving along with business confidence, Palace saw its highest traded value in a single year during 2016 to the tune of $21.5 Million which was more than all of the prior years going back to 2002 combined. The influx of new investors with capital to invest saw Palace rise from $60 at the end of their 2015 FY to $165 by 2016. The “Black Panther” effect drove investors to the company’s stock to astronomical levels where it closed June 2018 at $1,425. It should be taken in context that the lack of supply (sellers) on the market was a major factor for the price’s meteoric rise against other listed companies on the market. As a result, the small 100 units being offered on almost any given trading day or period with a much higher asking price allowed for the stock to rise by $100-200 on any given trading day. This low supply and relatively eager demand for the stock saw the stock price rise from $1,301 on August 5, 2019 to $2,500 on August 14, 2019.

Palace Amusement peaked on November 28, 2019 at $2,900 per share which made it the most expensive ordinary shares on the JSE with a market capitalization (number of ordinary shares * market price) of $4.17 Billion ahead of JPS 9.5% preference shares which trades at $1,302 per share. However, since December 1, 2019, the JSE switched over to the NASDAQ platform which allowed for investors to purchase 1 unit of any listed security on the JSE. This new ‘advancement’ allowed for a more flexible pricing opportunity for investors to buy incremental units of Palace without buying 6 figures of the stock as it had occurred in the past. Thus, instead of paying $170,000 for 100 units of Palace Amusement’s stock, investors could now buy 1 unit at $1,700 which is equivalent to the price of a regular 3D movie ticket for an adult. As a result, Palace dove by $1,089 from $2789 to $1,700 on May 6, 2020 with just 3 units being traded. As of May 15, the company’s stock price is $1,500 which puts it at a PE (price to earnings) ratio of 24.74 and a PB (price to book) ratio of 4.25. This contrasts with periods before 2015 where Palace had a low/negative PE and a PB which had never surpassed 1.

Quarter 2 2019/2020 Analysis

Palace derived 19.62% more in revenues for the December 2019 quarter which stood at $299.9 Million when compared against $250.7 Million in the prior quarter. This could be attributed to films such as Frozen, Jumanji and Sprinter (which was the first big ticket Jamaican feature film in years to bring in a repeat showing for moviegoers). However, Palace’s gross profit margin suffered during the quarter primarily due to the opening of Sunshine Palace and the State of Emergency restrictions which reduced their show times and decreased patronage of their St. Catherine consumer base. This left Palace with a meagre 9.78% gross profit margin which was far from the historical 15-20%. As a result, the company ended up with an operating loss and subsequent net loss for the quarter of $18 Million with only $9,000 attributable to non-controlling interests (interest shareholders of the company don’t own). However, revenues for the 6 months was up by 28.80% to $669.9 Million while net profit for the 6 months ended at $149,000 which reflects the success of the June – September quarter in preventing a loss from being recorded for the period under review. It should be noted that Sagicor Investments Limited (subsidiary of Sagicor Group Limited) paid for all evening shows at all Palace theatres (excluding Carib Cinema) on October 25, 2019. This guaranteed form of box office receipts in addition to the confectionery sales would have boosted revenues across the various locations during the quarter.

The company’s non-current asset base rose by 4.41% to $580.6 Million when compared with the end of the 2019 Financial Year at $556.1 Million. This was due to the encashment of $30 Million in Investments from the Sagicor Sigma Global Fund Investments and $77 Million into property, plant and equipment which was attributable mainly to the Sunshine Palace investment. The current asset base rose by 21.75% to $178.7 Million with cash and cash equivalents and receivables up by more than 45% each while the inventory went down by 17% over the same period. Current liabilities increased by 24% over the same period which further deteriorated the company’s working capital (current assets – current liabilities) to -$45 Million. Non-current liabilities went up by 63% as the company took out a new loan during the period.

Although the company had a minuscule net profit, they were able to generate cash flow from operations to the tune of $36.8 Million after adjusting reconciling for non-cash items and changes in working capital. Cash flow from investing activities showed a cash outflow of -$44 Million which was mainly attributed to the major changes in the non-current asset base of the company. Cash flow from financing activities revealed a cash inflow of $27.2 Million as the company took out a new loan for an unknown activity. The result of these various cash flow changes was an increase in $20.4 Million for cash into the business.

Under the segment reporting analysis, Palace Cineplex showed an increase in total revenue over the prior 6 month period while Carib Cinema and Palace Multiplex saw a decline in the same time frame. However, Palace Multiplex was able to generate a greater amount of income. Sunshine Palace was able to generate $122.2 Million in revenue which was ahead of the Palace Cineplex, but ended up recording a loss of $6.6 Million. Film activities and screen activities also showed a general increase in revenue as advertisements and rental of films became more lucrative during the period.

Post Quarter 2 Analysis

On March 10, 2020, Jamaica recorded its first positive case of COVID19. As a result, Champs and all large gathering events were subsequently cancelled with Palace following suit on March 14 to close all its theatres until further notice. The display board which was visibly filled with movie titles only has “We Miss You All” now. This was in the last 3 weeks of the company’s third quarter which would inevitably affect the company’s top and bottom line. Since their closure, there has been no word from the company on possible staff layoffs or negotiations with their lenders and vendors on rearranging payment terms. There has also been no disclosure to the JSE nor notice for a delay in their quarterly results. During the month of May, the government began to relax some restrictions on the nationwide curfew.

COVID19 and Palace’s Future

With COVID19 effectively shattering any business model which relies on large clusters of people to generate revenue, Palace is effectively closed until COVID19 begins to subside and they can incentivize customers to return to their theatres. The current curfew which is in place and negative economic climate will make it extremely difficult for Palace to bring in any customers for any movie viewing. A curfew effectively limits the show times for the company and discretionary spending is declining as pay cuts increase. More people have become unemployed and uncertainty in the environment makes people consume less in an effort to conserve cash. All major films such as F9, Black Widow and Wonder Woman 1984 which were supposed to be released during 2020 have been shelved to 2021 or premiere later in the year. These action films which are usually summer blockbusters tend to generate a significant amount of revenue for the company as movie goers continue to follow these movie franchise continuations which tend to be viewed in 3D.

“The display board which was visibly filled with movie titles only has “We Miss You All” now.”

Another major threat facing Palace is a possible consumer shift to rental of movies through an online distribution company in the form of streaming and video on demand. With Trolls World Tour generating $100 Million in rental fees in North America during the national shutdown and other films being released on other platforms such as Apple TV, there is a possible risk in the future of consumer behaviour shifting towards this option if they still feel unsafe. This means of distribution resulted in Universal retaining about 80% of the rental or digital purchase fee compared to the higher share it cedes to movie theatres. Although the Caribbean region may not be as quick to transition to this form of digital consumption for new movies, it remains a viable risk for the company’s future in the form of revenue shifting to a different company.

To counter the current loss of its box office receipts (ticket sales) and screen advertising revenue, the company has engaged with Quickplate to deliver a “box deal” to customers. In addition, they have opened their Palace Cineplex location for the sale of their various inventory items. This will act as a means for the company to convert their inventory to cash since inventory is still a perishable item which loses value as time progresses. Although this won’t be enough money to cover their general expenses such as security, staff and lease costs, it will still act as a way for the company to shore up cash and get an understanding from their customers about how they feel about returning to the theatres in the future.

With the uncertainty surrounding COVID19 and movie theatres more than likely to become the last set of locations which can reopen fully, the company faces an unknown future without guidance on how it should proceed. The reduced return for its Sunshine Palace location has put the company in a precarious position since no one can tell how the economy will fare going forward. However, MovieTown based in Trinidad & Tobago might not go ahead with its desired Caribbean expansion this year due to the COVID19 pandemic. This possible delay will give the company some time to try and see if it can keep its customer base loyal in the event an outside competitor joins the market space they currently control. TRP Insights highlighted that it took 31 quarters (approximately 8 years) for Jamaica’s labour force to return to the pre-crisis of 2008. With unemployment at a high, the IMF predicting a 3% reduction in the global GDP with Jamaica expected to contract by 5.6% and the government expected to lose $89 Billion in revenue and $120 Billion overall for the fiscal year, discretionary spending may take a few years to return to normal.

Until next time, stay safe, maintain your distance and Tan Ah Yuh Yard as we try to flatten the curve with COVID19. Be diligent while reading the most recent earnings season results. Not all losses are cash based and observe the liquidity and solvency of each company.

-DR

Note: This article is not intended to be financial advice or come off as a stated buy, hold or sell position against this company. I am not a licensed financial advisor and this article is intended to provide oversight and information on a listed JSE company.